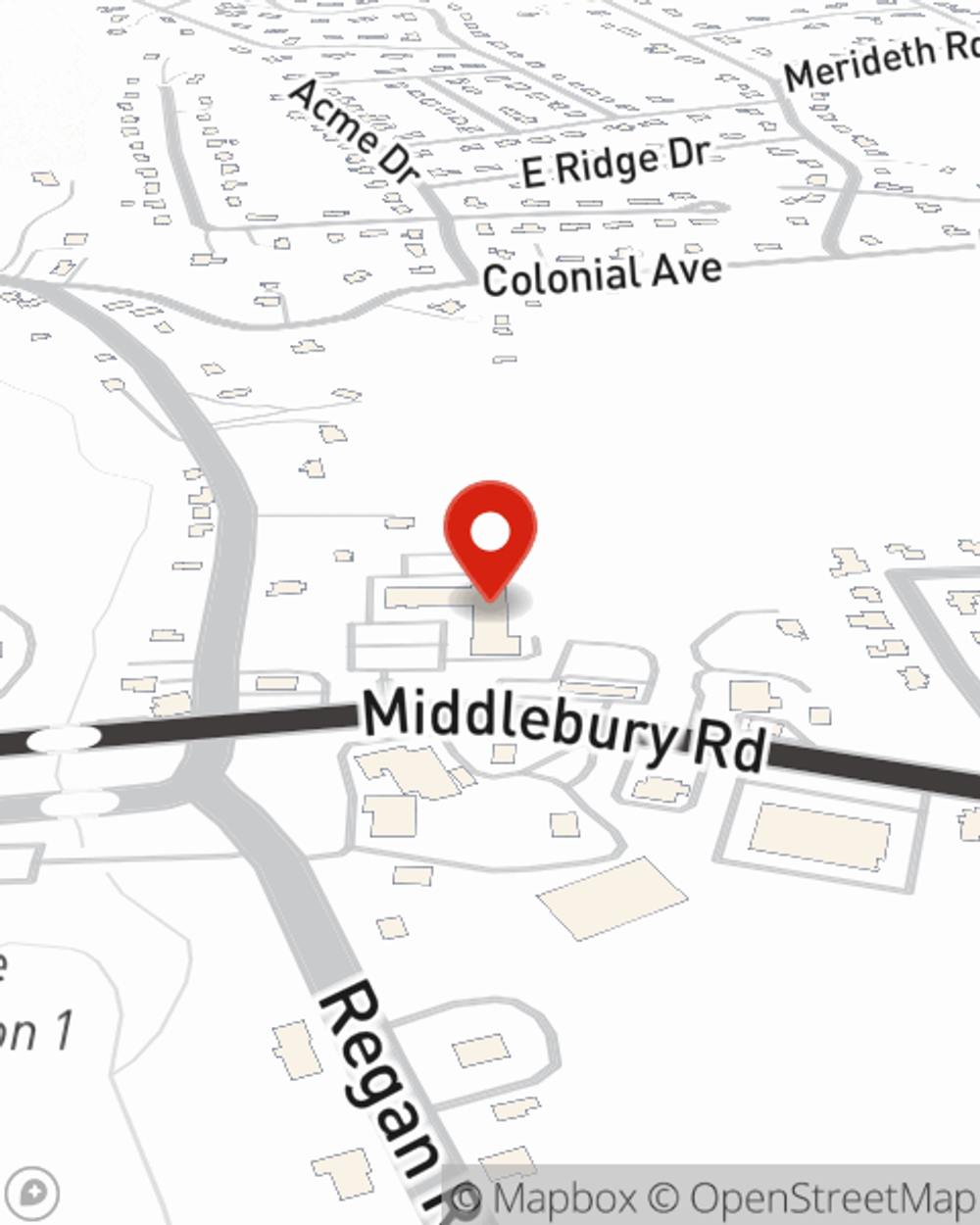

Renters Insurance in and around Middlebury

Middlebury renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Naugatuck

- Southbury

- Woodbury

- Oxford

- Waterbury

- Roxbury

- Washington

- Newtown

- Southington

- Cheshire

- Prospect

- Beacon Falls

- Wallingford

- Hamden

- Stamford

- Ansonia

- Derby

- Watertown

- Norwalk

- Bethlehem

- Fairfield

- Monroe

- Middletown

- Danbury

Home Sweet Home Starts With State Farm

Trying to sift through savings options and deductibles on top of work, your pickleball league and managing your side business, can be overwhelming. But your belongings in your rented home may need the terrific coverage that State Farm provides. So when mishaps occur, your pictures, furnishings and shoes have protection.

Middlebury renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

You may be skeptical that having Renters insurance can be beneficial, but what many renters don't know is that your landlord's insurance generally only covers the structure of the apartment. The cost of replacing your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when abrupt water damage from a ruptured pipe occurs.

If you're looking for a value-driven provider that can help you protect your belongings and save, reach out to State Farm agent Marta Nerin today.

Have More Questions About Renters Insurance?

Call Marta at (203) 528-3779 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Marta Nerin

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.